It's official: The housing crisis that began in 2006 and has recently entered a double dip is now worse than the Great Depression.

|

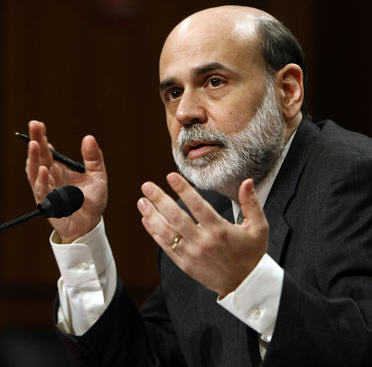

Getty Images |

Prices have fallen some 33 percent since the market began its collapse, greater than the 31 percent fall that began in the late 1920s and culminated in the early 1930s, according to Case-Shiller data.

The news comes as the Federal Reserve considers whether the economy has regained enough strength to stand on its own and as unemployment remains at a still-elevated 9.1 percent, throwing into question whether the recovery is real.

"The only comfort is that the latest monthly data show that towards the end of the first quarter prices started to fall at a more modest rate," he said. "Nonetheless, prices are likely to fall by a further 3 percent this year, resulting in a 5 percent drop over the year as a whole."

Prices continue to tumble despite affordability, which by most conventional metrics is near historic highs.

The rate for a 30-year conventional mortgage is around 4.5 percent, just above the historic low of 4.2 percent in October 2010. The ratio measuring mortgage costs to renting is 7 percent below its norm, while the price-to-income ratio is 23 percent below its average, Dale said. Yet other factors are constraining the market.After the fallout from the sub-prime debacle, in which millions lost their homes when they defaulted on loans they could not afford, banks changed underwriting standards. More than four in every five mortgages now require a down payment of 20 percent, and credit history standards have tightened. At the same time, foreclosures continue at a brisk pace, pushing more supply onto the market and pressuring prices downward.

Then there is the issue of underwater homeowners—those who owe more than their house is worth—representing another 23 percent of homeowners who cannot leave or are in danger of mortgage default.

Indeed, the foreclosure problem is unlikely to get any better with 4.5 million households either three payments late or in foreclosure proceedings. The historical average is 1 million, according to Dales' research.

The only bright spot Dales found, aside from the slowing in price drop in March, was some isolated strength in states such as Nevada, Michigan, South Dakota, Alaska and Iowa.